Top Health Insurance Program to Secure Your Health

When it involves prioritizing your health, picking the ideal health and wellness insurance policy plan is a critical decision. The marketplace is filled with alternatives, each boasting numerous features and advantages. Not all plans are developed equivalent, and knowing exactly how to navigate via the sea of options can be intimidating. Recognizing the subtleties of top medical insurance strategies, including protection specifics, premiums, and additional perks like health cares, is vital for making a notified decision that safeguards both your health and wellness and funds. Allow's explore the essential variables that can help you pick a strategy that best fits your demands and supplies comprehensive defense for your well-being.

Secret Functions of Top Medical Insurance Program

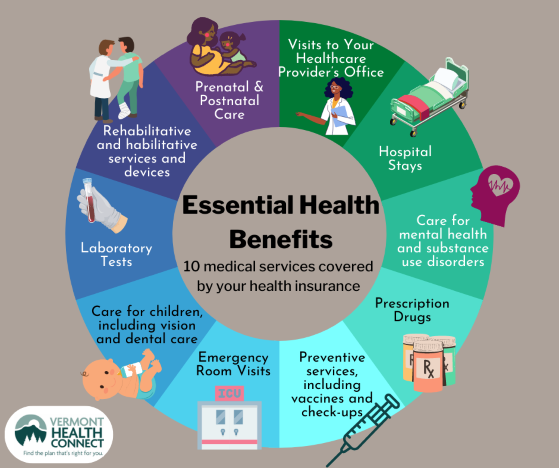

When assessing leading medical insurance plans, a critical facet to think about is their comprehensive insurance coverage alternatives. A robust health insurance strategy must offer insurance coverage for a variety of medical solutions, including medical facility stays, medical professional brows through, prescription medicines, precautionary treatment, and psychological health solutions. Comprehensive protection guarantees that people and family members have access to the treatment they need without facing significant economic worries.

Moreover, leading medical insurance plans commonly offer added advantages such as insurance coverage for alternate treatments, maternal care, and vision and oral services (Cobra insurance). These extra benefits can assist individuals customize their coverage to satisfy their specific health care demands

Furthermore, leading medical insurance strategies usually have a broad network of medical care carriers, including hospitals, physicians, professionals, and drug stores. A robust network guarantees that participants have accessibility to high-quality care and can quickly locate healthcare service providers within their protection area.

Comparison of Costs and Insurance Coverage

Costs and coverage are vital variables to consider when comparing different wellness insurance strategies. Premiums are the quantity you pay for your wellness insurance policy protection, generally on a month-to-month basis - Health insurance agent near me.

Coverage refers to the solutions and benefits supplied by the health and wellness insurance plan. A plan with comprehensive coverage may have greater premiums but can eventually conserve you money in the lengthy run by covering a greater portion of your health care expenditures.

Benefits of Consisting Of Health Programs

An important element of health insurance plans is the consolidation of wellness programs, which play an essential function in advertising total wellness and preventive treatment. Health care include a variety of initiatives focused on improving people' well-being and reducing health threats. By consisting of health cares in medical insurance plans, insurance policy holders get to different sources and activities that focus on enhancing physical, mental, and emotional health and wellness.

One significant advantage of including health cares is the focus on preventive care. These programs commonly include regular health and wellness testings, inoculations, and lifestyle coaching to aid individuals keep healthiness and address prospective concerns prior to they escalate. Furthermore, wellness programs can encourage healthy behaviors such as routine workout, well balanced nourishment, and stress and anxiety management, eventually leading to a healthier way of life.

Understanding Plan Limitations and Exemptions

Policyholders should be aware of the constraints and exemptions outlined in their wellness insurance intends to fully comprehend their coverage. Exclusions, on the other hand, are specific solutions or problems that are not covered by the insurance coverage strategy. It is recommended for insurance holders to evaluate their plan records thoroughly and seek advice from with their insurance carrier to clarify any type of unpredictabilities regarding protection constraints and exemptions.

Tips for Choosing the Right Strategy

When selecting a medical insurance strategy, it is vital go to these guys to carefully assess your healthcare demands and economic factors to consider. Begin by examining your normal medical demands, including any chronic problems or possible future needs. Think about factors such as prescription medicine coverage, access to professionals, and any kind of expected procedures or treatments. It's additionally critical to examine the network of doctor included in the plan to guarantee your favored physicians and medical facilities are covered.

Furthermore, think about any type of extra benefits offered by the plan, such as wellness programs, telemedicine solutions, or coverage for alternative treatments. By thoroughly assessing use this link your health care requirements and economic circumstance, you can select a medical insurance strategy that successfully safeguards your well-being.

Conclusion

In verdict, selecting a top medical insurance strategy is critical for safeguarding one's health. By contrasting costs and insurance coverage, including health cares, recognizing plan limitations and exclusions, and picking the ideal strategy, people can guarantee they have the essential security in place. It is essential web link to meticulously take into consideration all facets of a medical insurance strategy to make an informed choice that meets their particular requirements and provides assurance.